Asset Management Ratios Do Not Measure Which of the Following

Earnings generated by efficient asset management b. Asset management ratios are also called turnover ratios or efficiency ratios.

Debt To Total Asset Ratio Efinancemanagement

Which of the following ratios measure how efficiently a firm uses its assets as well as how efficiently the firm manages its accounts payable.

. Inventory turnover ratios measure how quickly inventory is produced and sold. Earnings generated by efficient asset management. It will indicate how good management use the assets to make sale for the company.

The inventory turnover ratio is used. Asset management Determine the interest rate earned on an 800 deposit when 808 is paid back in one year. Productivity of fixed assets in terms of sales b.

How efficiently inventory is being managed d. Asset management ratios are also known as asset turnover ratios and asset efficiency ratios. These ratios provide important.

It measures how much the company uses debt to support its operation compare to other sources of finance such as share equity and retaining earning. The higher the ratio the better because a high ratio indicates the business has less money tied up in fixed assets for each unit of currency of sales revenue. All of the above are measured by asset management ratios 32.

Productivity of fixed assets in terms of sales how current assets are used in. Asset management ratios do not measure which of the following. _____ measure the ability of an organization to convert assets into the cash it needs to pay off liabilities that come due in the next year.

How much sales are generated from fixed assets. Earnings generated by efficient asset management с. If you dont have enough invested in assets you will lose sales and that will hurt your profitability free cash flow and stock price.

Which of the following ratios would not be classified as an asset management ratio. Efficiency ratios measure a companys ability to use its assets and manage its liabilities effectively. Asset Management Ratios Asset management turnoverefficiencyasset utilization ratios measure how effectively the firms assets are being managed.

A Current ratio B Inventory turnover ratio C Accounts payable period D Capital intensity ratio. Question 8 of 25 40 Points Asset management ratios do not measure which of the following. The inventory turnover ratio.

Productivity of fixed assets in terms of sales. -Debt management ratios measure the extent to which a firm uses debt to finance its assets-Debt management ratios determine whether or not a firm can meet its debt obligations-Debt management ratios determine the amount of financial leverage used by a firm. Productivity of fixed assets in terms of sales b.

Asset management ratios do not measure which of the following. Asset management ratios measure how efficiently a firm uses its assets inventory accounts receivable and fixed assets as well as its accounts payable Valley Markets has an inventory turnover of 32 and a capital intensity ratio of 19. C Question 9 of 25 40 Points.

Fixed asset turnover Net sales Average net fixed assets. How current assets are used in the generation of sales c. Company can raise capital from both debt and equity.

Productivity of fixed assets in terms of sales b. Asset management ratios do not measure which of the following. Examination of assets management ratios shows how proficiently and successfully an organization utilizes its resources to produce income.

If you have too much invested in your companys assets your operating capital will be too high. A declining ratio may indicate that the business is over-invested in plant equipment or other fixed assets. Assets management ratio is the tool to measure company effectiveness and efficiency in using assets to generate revenue and expand the business.

Common examples of asset turnover ratios include fixed asset turnover inventory turnover accounts payable turnover ratio accounts receivable turnover ratio and cash conversion cycle. Mar 09 2022 0608 AM. Where as Asset turn over ratio determines how efficiently or effectively an organization is using its assets.

__________is an asset management ratio that measures how quickly a firm sells its stock to generate revenue. Receivable turnover ratios provide information on the success of the firm. Asset management ratios are computed for different assets.

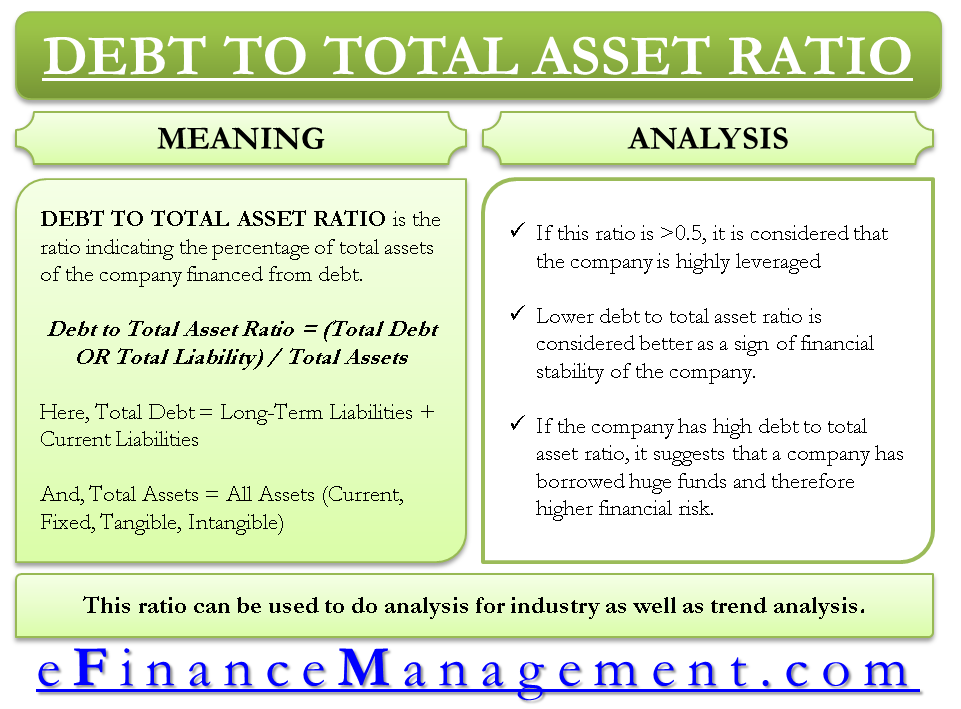

It compares the sale amount with the total balance of the company assets. Debt ratio is the financial ratio that measures the company debt to total assets. They demonstrate the capacity of an organization to change over its resources into deals.

Earnings generated by efficient asset management. Asset management ratios do not measure which of the following. Asset management ratios do not measure which of the following.

Do we have the right amount of assets for the level of sales. How current assets are used in the generation of sales. How current assets are used in the generation of sales.

How much sales are generated from fixed assets d. The capital intensity ratio is a financial calculation measuring how much a company is invested in total assets compared to how much it is earning in revenue. Assets management ratio is otherwise called resource turnover rates and resource productivity proportions.

Aproductivity of fixed assets in terms of sales Bhow current assets are used in the generation of sales Correct Cearnings generated by efficient asset management Dall of the above are measured by asset management ratios Answer Key.

Tobin S Q Ratio Accounting And Finance Financial Strategies Business Content

Pin On Liquidity Ratio Analysis

Working Capital Turnover Economics Lessons Financial Management Accounting And Finance

Comments

Post a Comment